Project Overview

There is increasing recognition among the international community of the need for urgent and concrete action in mitigating climate change, and addressing its impacts by effectively supporting particularly vulnerable countries’ own efforts to manage climate change induced disaster risk. Well-designed climate risk insurance – when applied in conjunction with other disaster risk management measures and strategies – can protect people against climate shocks by acting as a safety net and buffer shortly after an extreme weather event. In 2015, we saw a major shift in political narratives about how climate change related risks are addressed moving away from an attitude of coping with impacts (ex-post) to that of effectively managing risks before they occur (ex-ante).

By initiating a Climate Risk Insurance Initiative (InsuResilience) in 2015, the G7 countries acknowledged the central role insurance plays in a comprehensive climate risk management approach. Building on the 2015 InsuResilience Initiative, G20 and V20 countries then moved to launch the InsuResilience Global Partnership in 2017 and to promote the development of a broad menu of climate and disaster risk finance instruments, including insurance (CDRFI). In bringing together representatives of the G20 and the V20, international organizations, the private sector, civil society and academia , the InsuResilience Global Partnership aims to aspire to delivering results in six areas: By 2025, (1) increase the number of people protected by risk financing and insurance arrangements to 500 million, (2) ensure vulnerable countries have comprehensive disaster risk financing strategies in place and (3) adopt CDRFI integrated with comprehensive risk management systems, while (4) increasing the cost-effectiveness of risk finance and insurance arrangements, (5) aligning increased disaster resilience with human development objectives and (6) building robust evidence for effective and cost-efficient climate and disaster risk insurance solutions.

Under the overall guidance of the German Federal Ministry for Development and Economic Cooperation (BMZ) and in cooperation with the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ), we are contributing to InsuResilience by providing strategic and technical advice to the members of the Partnership, specifically the V20 Group as well as the InsuResilience Secretariat, facilitating dialogue among stakeholders, including private sector, civil society and partner countries, and undertaking research on the nexus between resilience, insurance and risk reduction.

Amongst others, this includes us co-chairing the Partnership’s Principles and Impact Working Group and providing technical advisory and support to the V20 regarding their engagement with InsuResilience and the development of the V20-led Sustainable Insurance Facility (SIF). The aim of our work is the design of needs-based advice to support vulnerable countries in their approach to climate and disaster risk financing, including insurance, and their leadership on related policy issues in the international arena.

Latest Project News

6th InsuResilience High Level Consultative Group sets the stage for more coordinated action on climate and disaster finance and insurance

April 21, 2022: Globally coordinated efforts to provide financial protection to the most vulnerable populations, countries and businesses are critically important to build long term resilience to climate risks. An effective global Climate and Disaster Risk Finance and Insurance Architecture (CDRFI) can facilitate a more proactive, cost effective and reliable response to climate risks for many climate vulnerable countries, including the Vulnerable 20 Group member countries. To make progress on the CDRFI agenda, members of the High-Level Consultative Group (HLCG) of the InsuResilience Global Partnership (IGP) reconvened for their sixth meeting on 7th of April 2022. Under the new co-chairmanship by Parliamentary State Secretary Dr. Bärbel Kofler from BMZ, Germany and His Excellency Mambury Njie, Minister of Finance and Economic Affairs of The Gambia, the HLCG discussed the vision of establishing a Global Shield against Climate Risks for climate vulnerable countries and communities.

Achieving the goal of reducing the 98% financial protection gap in vulnerable countries, as strongly highlighted in the V20 climate prosperity plans, urgently requires more coordinated efforts. Further, climate change risks amplified by complex and cascading risks, such as Covid 19, are rapidly reducing the available fiscal space to deal with climate change in many low and middle income countries. For example, between 2010 and 2018, external debt payments as a percentage of the government budget grew by 83% in low- and middle-income countries, including the V20 countries. Recognizing the urgency of the climate crisis, the HLCG focused on ways to reduce the high protection gap among climate vulnerable V20 countries.

Building on the outcomes of the 5th HLCG in October 2021, with the aim to enhance the global CDRFI architecture, the 6th HLCG meeting focused on Global Shield against climate risks. Following the InsuResilience recommendations on improving the global climate and disaster risk finance and insurance (CDRFI) architecture and the Principles for SMART Premium and Capital Support, the German G7 presidency proposed to jointly work towards a Global Shield against Climate Risk. Jürgen Zattler, Director-General for Climate at Germany’s Federal Ministry for Economic Cooperation and Development (BMZ) introduced the proposal of the global shield, which consists of three key components: 1) a truly global, flexible, and collaborative financing structure; 2) strong coordination between implementing programmes to overcome fragmentation through a redesigned InsuResilience Programme Alliance; and 3) G7 endorsement of the SMART Premium and Capital Support Principles.

As highlighted in the Co-Chair Conclusions, all HLCG members provided their valuable feedback on the proposal to establish a truly effective global shield against climate risks considering the needs of the low and lower middle income countries including the V20 group. Emphasizing the importance of insights from V20 countries, V20 Co-Chair (*Minister of Finance and Economic Affairs of The Gambia, Mambury Njie) highlighted the urgent need to establish a global shield that provides the much-needed financial protection against climate-induced risks for governments, micro, small and medium-sized enterprises, and communities. He reiterated that “to respond to V20 needs, the global shield must above all, focus on mobilizing and building access to new financial resources and support the preparation for vulnerable country government institutions.”

As defined and developed by the V20, G20 and the development partners of the InsuResilience of the global partnership, Co-Chair, His Excellency Harifidy Ramilison, Minister of Agriculture and Livestock of Madagascar emphasized the integration of the SMART Premium and Capital support principles into the proposed Global Shield. His Excellency highlighted the need of operationalization and implementation of the SMART principles as part of the Global Shield and called for a mix of finance under the global shield consisting of 1) insurance 2) anticipatory finance 2) disaster finance and 4) social safety nets.

As strongly emphasized in the V20 Senior Officials Meeting in April 2022, many climate vulnerable countries, including the V20 countries, are already suffering from very low access to international climate funds. Focusing on the critical role of financial support, Getahun W. Garedew, Director General of the Ethiopian Environmental Protection Authority (EEPA) reiterated the need for support towards financial protection under the Global Shield. This is especially important in the face of increased debt-stress and the high-cost of capital that also reaches local actors and addresses long term resilience needs. Similarly, the V20-representative from Bangladesh, Joint Secretary and Wing Chief Kabir Ahmed, Economic Relations Division of the Ministry of Finance, stressed that insufficient adaptation responses and the financial protection gap translate to rapidly growing losses and damages, creating pressing macroeconomic concerns for the V20. To counteract this, Joint Secretary Ahmed proposed institutional responses that give V20 countries the opportunity to utilize their fiscal space in a sustainable manner, while having access to immediate liquidity.

To steer effective investments under the global shield, V20 members also stressed the importance of strengthening in-country climate risk analytics capacity to develop greater local ownership of risk analysis. This is “essential to upgrading climate-resilient business models responsive to long-term investment planning”, explained Joint Secretary and Wing Chief Khabir Ahmed. The V20 members welcome the Global Risk Modelling Alliance (GRMA) to make risk analytics accessible. While emphasizing the need for risk analytics capacity building in V20 countries, Joint Secretary Khabir Ahmed highlighted that “gaining country-driven views of risk is fundamental to constructing a responsive risk management system”.

Besides access and mobilization of finance, increased collaboration and coordination between and among delivery partners to decrease global CDRFI fragmentation through the Global Shield was strongly advocated by the V20 members. Creating an effective and appropriate in-country delivery structure that can channel funds with precision and speed to locations of vulnerability as part of the Global Shield, was stressed by the V20 and broadly supported by other HLCG members as well. Further highlighting the importance of demand side coordination to efficiently implement the Global Shield, Assistant State Secretary Paola Alvarez from the Philippines emphasized “that designing supply-side solutions without demand-side coordination will have limited effect, and demand-side engagement is central to the success of such initiatives.”

During the meeting, HLCG members also discussed the need to reform the Programme Alliance, the current governance structure of the InsuResilience Global Partnership. The V20 Group welcomed the proposal to redesign the Programme Alliance to be a central platform for coordination and collaboration under the Global Shield and emphasized the importance of V20 representation in decision making structures under the global shield and financial structure. Acknowledging that V20 representation in global governance decisions remains weak and continues to result in outcomes that do not go far enough to protect the interests of the world’s most vulnerable groups or the planet, V20 members urged to enhance the inclusivity of decision-making processes and to include V20 representation in relevant workstreams, ministerial meetings and as observers. HLCG members should strive to further collaborative engagement with most vulnerable economies building on examples such as the InsuResilience Global Partnership.

After insightful deliberations on the Global Shield by all HLCG members, V20 Co-Chair Mambury Njie concluded on his part by calling on everyone to work towards accelerating the implementation of a Global Shield which puts the needs of climate vulnerable economies and communities at its center. G20+ Co-Chair Bärbel Kofler highlighted that the German G7 Presidency will ensure that the valuable feedback of the HLCG members, especially the V20 members, will feed into the further G7 process. The next step in this endeavor will be the meeting of development ministers on 18–19 May 2022. Germany will rally G7 partners to make progress on improving the global climate and disaster risk insurance and finance architecture to better protect climate vulnerable countries and communities.

With important discussions on the need and importance of establishing a Global Shield Against Climate Risks to reduce the fragmentation in the global CRDFI architecture, it is essential to stimulate further actions from G7, G20 and V20 engagement in coming months. An effective and efficient global finance architecture based on the needs and requirements of the vulnerable countries, sectors and communities will be important to establish a responsive and pro-active Global Shield Against Climate Risks.

Glasgow, 9 November 2021: The Vulnerable Twenty Group of Finance Ministers (V20) — comprising 55 climate vulnerable economies with a combined population of 1.4 billion people — reached one of their key milestones during a high level event today, and launched the V20 Sustainable Insurance Facility (SIF). The high level meeting was jointly convened at the sidelines of COP26 by the V20, the UN Environment Programme’s Principles for Sustainable Insurance (PSI), the Munich Climate Insurance Initiative (MCII) and the G20+ and V20-led InsuResilience Global Partnership.

According to the latest IPCC report from August 2021, severe climate impacts, originally thought to be more long term, will materialize much sooner than expected. Climate change is now in a constant state of acceleration and this can only spell economic and financial disruption and destruction while leaving behind devastation for the world’s most climate vulnerable developing countries, and are beginning to impact developed countries.

Announcing the launch of the SIF, H.E. Brenson Wase, Minister of Finance of the Republic of the Marshall Islands, member of the V20 Troika and Co-Chair of InsuResilience highlighted that “the SIF has come a long way” and how “the need for comprehensive and climate-smart insurance solutions for micro, small and medium-sized enterprises (MSMEs) has first been highlighted in 2017, at our V20 Regional Consultation in the Asian Development Bank in Manila.”

According to Minister Wase, the V20-led SIF will now be operationalized as a Project Pipeline Facility and represents “the first vulnerable country-led implementation mechanism in this space to date.” He also specifically thanked the SIF’s technical partners, including MCII and the Asian Development Bank, and the German Federal Ministry for Economic Development and Cooperation (BMZ) for being the first G20+ member of the InsuResilience Global Partnership that has publicly confirmed its support. Dr. Maria Flachsbarth, Parliamentary State Secretary to the Federal Minister for Economic Cooperation and Development, Germany emphasized that “Germany is pleased to support the V20-led Sustainable Insurance Facility starting in 2021, as it will enable V20 countries to submit tailor-made project proposals to better protect small enterprises against extreme weather events.”

The SIF is a Project Pipeline Development Facility which will assist the members of the V20 in scoping the financial protection needs of MSMEs in the context of climate change, and in facilitating concept and proposal development for submission to risk financing vehicles. As such, the SIF aims to mobilize international financial and technical assistance, with the objective of stimulating climate-smart insurance offerings by domestic and regional insurers to protect MSMEs and the people that rely on them. The overall goals include building local and regional insurance markets to improve risk sharing and absorb financial shocks, developing resilient business models, and freeing up public and private resources for investment in resilience and growth.

In V20 countries, MSMEs contribute between 20 and 70 per cent of GDP, constitute more than 80 per cent of all businesses, and contribute to the countries’ export revenues. Vulnerable developing countries suffer from a 90 per cent protection gap for climate risks and non-life insurance penetration in V20 economies, usually indicative of the degree to which private sector is covered, mostly lies below one or between one to two percent. MSMEs and cooperatives aggregate large population parts and thereby provide the potential to reach many people — owners, employees or small, family-owned businesses — directly or indirectly with insurance.

Moreover, and as emphasized by Mr. Amal Krishna Mandal Joint Secretary, Economic Relations Division, Ministry of Finance, Bangladesh, the SIF is intended to help countries “protect their asset base, secure supply chains and maintain output and price stability in line with a future-proof economy as set out in Bangladesh’s Mujib Climate Prosperity Plan.” Together with the recently announced strategic collaboration on open access to risk analytics between the V20 and the Insurance Development Forum (IDF), the SIF is sought to address gaps in the current disaster risk finance architecture and add to a more strategic and systematic approach of protecting economies from climate risk.

Over the course of 2022, the SIF will now be operationalized through a dedicated Project Office, hosted by the UN Environment Programme’s Principles for Sustainable Insurance (PSI) Initiative — the largest collaboration between the UN and the insurance industry — and supported by the MCII. The tasks of the SIF Project Office will focus on developing project concept notes and proposals under the leadership of V20 Finance Ministries in line with the five SIF Action Areas; the identification of interested implementing partners to translate such proposals into action; their submission to financing vehicles dedicated to addressing disaster risk; and accompanying in-country implementation in an advisory capacity. Butch Bacani, who leads the PSI at the UN Environment Programme, host of the SIF Project Office, welcomes the new initiative as “The creation of the V20 Sustainable Insurance Facility is a clarion call for leadership, determination and innovation from all actors to ensure that adaptation and resilience cease to be the forgotten half of the climate equation as we strive to achieve a just transition to a net-zero emissions economy.”

Yet, building domestic insurance markets in parallel to strengthening MSMEs’ demand for insurance through targeted financial and climate risk advisory as envisioned by the SIF will be no simple task. Minister Wase, who also commended MCII, UNEP’s PSI Initiative and InsuResilience for their continued support, underscored that “we must accelerate action at an unprecedented pace.” Over the coming months further synergies with additional potential partners, including the US and the UK which also reflected upon the value of the SIF during the event, will be explored.

While completing the set-up of the SIF Project Office in 2022, the V20 will further expand SIF activities across Asia-Pacific, including to Fiji, Bangladesh and the Marshall Islands. Simultaneously, the V20 will also bring the SIF to V20 members from Africa and the Middle East, Latin America and the Caribbean as well as build collaboration with relevant regional actors, including multilateral development banks, and other risk financing vehicles such as the World Bank IFC’s Global Index Insurance Facility (GIIF). Other organizations that attended the SIF event and expressed preparedness to collaborate include the African Risk Capacity, the InsuResilience Solutions Fund, Global Parametrics, ICEA LION, and Swiss Re.

Such inclusive and widespread collaboration is expected to foster regional learning and mobilize finance to those who need it the most. As highlighted by Mr. Sabiti Fred, National and Technical Advisor on Environment and Climate Change, Ministry of Finance and Economic Planning, Rwanda, there is a need to “better streamline our efforts by linking the international financial protection agenda more strongly with ongoing efforts around strengthening financial inclusion and access to credit for households and businesses.” Ultimately, investing in the resilience of the most vulnerable is not only an urgent humanitarian need. It is also a sensible strategy for building a more resilient global economy in today’s highly interconnected world.

Applauding the efforts of the V20, H.E. Kwaku Afriyie, Minister of Environment, Science, Technology and Innovation, Ghana, summarized that “bringing down global greenhouse gas emissions to the 1.5-Centigrade limit of the Paris Agreement is urgent for our survival, and the accelerating of climate-fueled impacts and disasters means that we need adaptation and risk management strategies. Key to the success of the two is climate risk data and financing, including for resilient investment and financial protection”.

Notes to Editors

About the V20

Formed in 2015, the V20 Group of Finance Ministers is a dedicated cooperation initiative of economies systematically vulnerable to climate change. It is currently chaired by the People’s Republic of Bangladesh. The V20 membership stands at 55 economies including Afghanistan, Bangladesh, Barbados, Benin, Bhutan, Burkina Faso, Cambodia, Colombia, Comoros, Costa Rica, Democratic Republic of the Congo, Dominican Republic, Eswatini, Ethiopia, Fiji, the Gambia, Ghana, Grenada, Guatemala, Guinea, Guyana, Haiti, Honduras, Kenya, Kiribati, Lebanon, Liberia, Madagascar, Malawi, Maldives, Marshall Islands, Mongolia, Morocco, Nepal, Nicaragua, Niger, Palau, Palestine, Papua New Guinea, Philippines, Rwanda, Samoa, Saint Lucia, Senegal, South Sudan, Sri Lanka, Sudan, Tanzania, Timor-Leste, Tunisia, Tuvalu, Uganda, Vanuatu, Viet Nam, Yemen.

For more information, please visit: www.v-20.org/

Contact Persons

For more information, please contact:

V20

- Sara Ahmed, Finance Advisor, V20: sara.ahmed@v-20.org

- Nabiha Shahab, Media Relations, V20: media@v-20.org

UNEP

- Diana Diaz, Programme Supervisor, UNEP’s Principles for Sustainable Insurance Initiative: diana.diazcastro@un.org

- Sally Wootton, Communications Lead, UNEP’s Finance Initiative: sally.wootton@un.org

MCII

- Viktoria Seifert, Manager – Disaster Risk Finance & Policy, Munich Climate Insurance Initiative: seifert@ehs.unu.edu

November 12, 2021: With V20 members suffering the increasing impacts of climate change together with persisting severe fiscal impacts of the Covid-19 pandemic, many see COP 26 as the last best chance to put humanity on a 1.5-degree path and avoid catastrophic consequences. Against the backdrop of these critical times, members of the governing body of the InsuResilience Global Partnership, the High-Level Consultative Group (HLCG) came together in their fifth meeting on October 27/28, 2021, to approve the Partnership’s efforts to establish the first international principles for premium and capital support (PCS) as an important part of strengthening the global climate and disaster risk finance and insurance (CDRFI) architecture.

Recognizing that the impacts of climate change are accelerating faster than earlier thought, with devastating fiscal and economic impacts on climate vulnerable low and lower middle income economies, the HLCG focused on enhancing the affordability of insurance instruments through a set of five SMART premium and capital support principles. Currently there is still a 98% financial protection gap in vulnerable countries, with financial protection against climate and disaster risks being almost non-existent. Other issues facing climate vulnerable countries were stressed to be at the center of considerations, specifically climate related increases of cost of capital and the looming public debt crises.

As highlighted in the Co-Chairs’ Conclusions published yesterday, the approval of the SMART principles followed the HLCG’s earlier discussions from June 2021, when they tasked the InsuResilience Secretariat to develop a proposal for decision-making. Drawing on the inputs from the V20 as also highlighted in the V20’s viewpoint on premium and capital support, these five core principles were further defined and developed by the V20, G20 and development partners of the InsuResilience Global Partnership.

During the October Meeting, Secretary Patrick Langrine who represented H.E. Finance Minister Brenson Wase from the Marshall Islands as the V20 HLCG Co Chair, emphasized that time-bound subsidization strategies through grants and concessional financing for climate and disaster risk financing products are key to gain sufficient market scale. Further, H.E. Mr. Carlos G. Dominguez, Secretary of Finance, Republic of the Philippines, member of the V20 group, emphasized that “CDRFI arrangements – including a premium support fund, pre-arranged, affordable and effective CDRFI instruments through micro and meso insurance and sovereign risk pools, and needs-responsive product offerings – need to support government-led responses and thus be tailored to the vulnerable countries’ specific needs and current fiscal circumstances.”

Towards this, V20 members of the HLCG also emphasized the need to spell out concretely who receives the PCS support, how much and for how long. Such decisions should be informed by important characteristics such as a country’s population, geography, economic and debt sustainability, and climate vulnerability. For example, most Small Island Developing States are still not eligible for concessional financing because they are classified as middle- or high-income countries. But they are more vulnerable than their income data might suggest.

For the first time, there is a global decision on the topic of premium and capital support. During the discussion, members of the HLCG also emphasized the need to move towards the operationalization of these principles as a necessary next step. Going forward, the Partnership will also address the operationalization of the principles to accelerate the access to disaster risk finance among low income and vulnerable population segments.

In the second part of the meeting, the HLCG addressed the needs for establishing the global Climate and Disaster Risk Finance and Insurance (CDRFI) architecture. The need for a global CDRFI architecture was based on the urgent reforms warranted in the global risk financing and insurance space. As already strongly highlighted in the V20 Climate Prosperity Recovery Agenda, and the V20 statement on opportunities for the resilience and sustainability trust, HLCG members from the V20 group emphasized that to mainstream climate risk analysis in public financial management, there is need for integrated risk management, including through investments in resilience, a risk-layered menu of financing instruments and reliable access to humanitarian funds for systemic risks.

While emphasizing the need for a global CDRFI architecture, H.E. Ms. Fatima Yasmin , Secretary of Economic Relations Division, Ministry of Finance, Bangladesh, the current presidency of V20 highlighted “the necessity for a better structure for the fragmented disaster risk financing institutions towards a more systematic delivery of ex-ante disaster risk and insurance finance is a key point of the V20 Climate Prosperity Recovery Agenda”. Moreover she also emphasized strengthening the institutional landscape at the macro, meso and micro levels for efficient delivery of ex-ante disaster risk finance to create the necessary institutional arrangements and improve access and affordability to safeguard global financial stability in the face of increasing climate-fueled shocks. Similarly H.E. Prof. Mr. Fekadu Beyene, Commissioner for the Environment, Forest, and Climate Change Commission of the Ethiopia, member of the HLCG singled out that the current global institutional global risk financing architecture is highly fragmented and specified that the future global CDRFI architecture has to be climate risk adjusted and fit to withstand increasingly concurrent and sequential shocks.

When highlighting the role of the IMF as a potential key institution within the global CDRFI architecture, Secretary Patrick Langrine from the Marshall Islands, reiterated that “Currently, we are missing the International Monetary Fund from the climate risk financing architecture. The current programs in the IMF focus on dealing with financial shocks while the physical shocks caused by climate change have inadequate support. The IMF’s new Resilience and Sustainability Trust Fund can complement efforts of InsuResilience to close the 98% financial protection gap in climate vulnerable countries, while together with Multilateral Development Banks, the IMF could also support V20 countries in incorporating fiscal buffers for climate-related risks in budget planning.” Similarly, the Co-chair of the HLCG, Dr. Maria Flachsbarth, Parliamentary State Secretary to the Federal Minister for Economic Cooperation and Development, Germany also highlighted that Germany would hold the G7 presidency in 2022 which will offer opportunities to build on progress made so far and rally G7 countries for enhancing the global CDRFI architecture.

After insightful deliberations, the HLCG approved to set the enhancement of the Global CDRFI Architecture as a core strategic topic for the InsuResilience Global Partnership in 2022 and tasked the InsuResilience Secretariat to summarize the discussion and provide guidance on potential next steps. In her closing remarks, Co-Chair Dr. Maria Flachsbarth from Germany announced her retreat from the HLCG and that once a new German government was formed, her successor would take over.

With important decisions on premium and capital support and the future of CDRFI reached during the 5th HLCH meeting, it is now high-time for further increased efforts from G7, G20 and V20 engagements in coming months towards a more need based and responsive ex-ante climate and disaster risk financing global architecture with higher PCS support. In this context, the V20-led Sustainable Insurance Facility (SIF) recently launched at the sidelines of COP26, is set to address an important gap: By focusing specifically on climate-smart insurance for micro, small and medium-sized enterprises, the V20’s SIF aims to provide protection complementary to solutions for households and governments and to facilitate the allocation of PCS to micro and meso insurance schemes.

As the US joins the InsuResilience Global Partnership, high level HLCG Meeting starts the first international dialogue on premium support

June 11, 2021: While many of the low- and lower middle-income countries, including the V20 membership, are still struggling to cope with the negative impacts of the Covid-19 pandemic, in a time where global temperatures are accelerating toward 1.5 degrees Celsius of warming, members of the governing body of the InsuResilience Global Partnership, the High-Level Consultative Group (HLCG) came together in their fourth meeting on June 1, 2021 to discuss the Partnership’s efforts to enhance the affordability of pre-arranged disaster risk finance, specifically insurance.

Recognizing that the lack of affordability is a major driver of low insurance uptake, the HLCG focused on the critical need of enhancing the affordability of insurance instruments through premium and capital support not only for improving vulnerable countries’ access to global risk carriers, but for building sustainable markets that can benefit from public-private partnerships. After insightful discussions, the meeting concluded by tasking the InsuResilience Secretariat with developing a Policy Note capturing members’ needs and priorities. The 5th HLCG Meeting, prospectively taking place in October 2021, will focus on reviewing this note and work towards a decision that enhances global coordination, transparency and cost-effectiveness of premium support. For the first time the issue of premium support – and with that the affordability challenge that climate change brings to risk insurance and risk finance – is discussed openly and systematically at the international level. This is a big win for the V20 group, which for a long time highlighted the need for systematic climate and disaster risk finance.

The deliberations were underpinned by the idea that the pandemic has clearly put forward just how important disaster preparedness and access to pre-arranged and predictable finance for countries really is. This is true specially for the V20 members where the debt risks have increased due to the pandemic spending. The current crisis brought about more use of post-disaster financing highlighting that vulnerable countries are underprepared for disasters, with the pandemic also having exacerbated debt risks in many low- and lower middle-income countries.

Yet, unlike many other developed countries, the majority of V20 members has faced climate disasters such as typhoons, hurricanes, heavy rain, or sudden drought at the same time. For example, as of September 2020, around 52 million people globally, most of them from lower or lower-middle income countries, have been directly affected by an overlap of floods, droughts, or storms and the pandemic. The increasing risks from both impacts of climate change and the pandemic highlights the changing nature of societal risks and why risk reduction solutions through insurance instruments are essential to build resilience to multiple shocks through greater ex-ante investment in preparedness.

However, disaster risk finance solutions and insurance markets in many low and lower middle-income countries, including the V20 membership, are largely underdeveloped or are not affordable resulting in high financial protection gaps.

Going forward, the Partnership will thus address the need of capital and premium support to accelerate the access to disaster risk finance among the low income and vulnerable population segments. Towards this, the HLCG decided work for more global coordination, transparency, and cost-effectiveness of premium support for risk transfer solutions.

To further strengthen the commitment towards providing support to V20 countries, Germany’s State Secretary Ms Flachsbarth, the G20 Co-Chair of the HLCG, also announced the support of Germany towards the V20’s Sustainable Insurance Facility (SIF) starting this year to which will enable V20 countries to enhance implementation action by developing and implementing tailor-made project proposals to better protect (Micro, Small & Medium Enterprises) MSMEs against extreme weather events.

Recognizing that one of the cornerstones of the Partnership’s work plan, the InsuResilience Vision 2025, has been to develop and mainstream a Monitoring and Evaluation (M&E) framework in support of tracking progress towards the Partnership’s ambitious targets, the HLCG, over the coming weeks will also review the indicators, targets, and methodologies developed so far. The objective is for HLCG members to affirm the reviewed Vision 2025 targets, based on the understanding that the M&E framework is no static framework, and provided further amendments as expressed by HLCG members will be considered.

Shortly after the HLCG Meeting, the US furthermore announced having joined InsuResilience, with first formal engagement planned for the upcoming 5th HLCG Meeting towards the end of this year.

With Covid-19 already causing high economic and social damage on the V20 countries’ finances, building financial resilience through climate and disaster risk finance and insurance solutions is critical and the need for pre-arranged finance for countries has never been more urgent. Now, as the US is back at the table and countries such as the Philippines and Bangladesh have joined the Partnership only by the end of last year, the expectations placed onto the InsuResilience Global Partnership are high.

In V20 economies, micro-, small- and medium-sized enterprises (MSMEs), contribute between 20 and 80 percent of GDP, constitute more than 70 percent of all businesses and power the countries’ export revenues. They are important drivers of socio-economic growth, arguably a key prerequisite for resilience and government revenue.

At the same time, MSMEs, including but not limited to agro-business, are often particularly vulnerable to extreme weather events and suffer from high electricity cost to the detriment of their productivity and growth. Low carbon technology options with deflationary costs for technologies such as rooftop solar and other, more energy efficient equipment and infrastructure, may help in addressing the latter. It is, however, difficult for MSMEs to secure upfront funds or financing options such as loan or leasing mechanisms. As a result, they are typically left with high operational costs, preventing them from investing in improving productive and operational efficiencies to increase the profitability of their business.

Even MSMEs’ ability to maintain the status-quo is threatened by the increasing frequency or intensity of natural hazards. This is because businesses often have low adaptive capacity due to 1) limited human and financial resources, 2) lack of accessible and useable information, including on climate risks, transition risks, energy efficiency and risk reduction measures, and 3) the cost of resilience and low carbon measures, including insurance. Worsening climate related natural hazards will further drag down economic productivity and resilience if the MSME sector does not have adequate insurance protection and investment capacity. These could help to absorb financial shocks from natural hazards and de-risk the implementation of cost-saving renewable energy and energy efficiency infrastructure.

Leveraging progress in closing the protection gap through climate-smart insurance for MSMEs

However, adequate insurance offerings to protect MSMEs and de-risk investments are often unavailable and so far, very few projects focus on climate-smart insurance specifically for MSMEs, and even less so on enhancing their risk management capacities in the process. Vulnerable developing countries experience an at least 90 percent protection gap for climate risks and non-life insurance penetration in V20 economies, typically indicative of the degree to which the private sector is covered, often lies below or between one to two percent. Yet, better insurance access and uptake among MSMEs can not only help to protect economic growth, but also reduce contingent liabilities on governments’ balance sheets, thereby widening the fiscal space for development.

The exact definition of what constitutes MSMEs varies across the V20, but micro-enterprises usually have one to five or up to ten employees, small businesses ten to 50, and medium-sized enterprises up to 300 employees. As such, the livelihoods of large population segments depend on them: In V20 economies, MSMEs make up 30 to 90 percent of employment.

This puts MSMEs in a unique role, in which they aggregate large sections of the population and thereby represent a policyholder group through which many people – owners, employees or small, family-owned businesses – can directly or indirectly benefit from insurance. MSMEs also offer important employment opportunities for lower-skilled workers and women. They therefore support particularly vulnerable population segments and also provide an avenue for developing their human capital. Designing and developing insurance products in collaboration with MSMEs, while simultaneously building their risk management capacities, can hence represent a powerful opportunity to train and educate entrepreneurs in financial literacy, climate risk literacy and business planning skills.

Currently, several barriers still impede the development and uptake of climate risk insurance among MSMEs. These include lack of regulation, consumer protection and tailored product offerings, taxes and effective distribution channels. Equally, climate risks and their prospective financial impacts are often unknown or not well understood by MSMEs. And those MSMEs that are aware of these impacts, frequently lack the capital, including through credit access, and business planning skills to invest in risk reduction and formulate disaster response strategies. These competencies are, however, relevant for making insurance cost-effective and for enabling MSMEs to better understand why they would need insurance and for what.

Strengthening the capacities of MSMEs may also enable their employees to gain an understanding of insurance. MSMEs’ financial management, creditworthiness and productivity may also be improved. As such, MSMEs can be seen as important aggregators, offering an entry point for leveraging progress towards achieving the InsuResilience Global Partnership’s 500 million protection target, contributing to human development and realizing its gender declaration.

Led by the V20 Group, the Sustainable Insurance Facility (SIF) promotes integrated efforts which address these issues. Doing so can also foster progress on other agendas, such as MSME finance, financial inclusion and sustainable supply chain management.

SIF At-a-Glance

New Background Paper:

Macrofinancial Risks in Climate Vulnerable Developing Countries and the Role of the IMF – Towards a Joint V20-IMF Action Agenda

Climate vulnerable countries face considerable macrofinancial risks that threaten debt sustainability, worsen sovereign risk, and harm investment and development prospects. Prepared in collaboration with the SOAS Centre for Sustainable Finance and the V20 Secretariat, this paper reviews the macrofinancial implications and risks of climate change, in particular the impacts of climate vulnerability on sovereign risk and the cost of capital, with special consideration to challenges facing the V20. It also examines the International Monetary Fund (IMF)’s responsiveness to these challenges to date and recommends ten initial areas for a joint V20-IMF Action Agenda.

The IMF can play an important role in supporting climate vulnerable countries in mitigating and managing macrofinancial risks stemming from the physical and transition impacts of climate change, leveraging opportunities from climate policies to boost growth, investment and resilience. While the IMF’s attention to climate issues has increased markedly, including through research produced by IMF staff, the Fund has been rather slow to address climate-related financial risks in its operational work, comprised of surveillance, technical assistance and training, and emergency lending and crisis support.

A non-representative survey among finance ministries and central banks of V20 countries indicates the desire for more support from the IMF in addressing climate risks and vulnerabilities. The views expressed by V20 members suggest that the IMF should integrate climate risk analysis in its surveillance activities, including Article IV consultations as well as Financial Sector Assessment Program assessments and Debt Sustainability Framework analysis conducted with the World Bank; scale up technical support; and explore options for developing its toolkit for climate emergency financing.

To address the needs of climate vulnerable economies and support them in building resilience through improved mitigation and management of climate-related macrofinancial risks and enhanced conditions for critical investments in adaptation and development, the paper suggests ten potential action areas for a joint V20-IMF Action Agenda:

- Mainstreaming systematic and transparent assessments of climate-related financial risks in all IMF operations

- Consistent, systematic, and universal appraisal and treatment of physical climate risks and transition risks for all countries in Article IV consultations and Financial Sector Assessment Programs

- Advancing disclosure of climate-related financial risks and promoting sustainable finance and investment practices

- Exploring synergies between fiscal and monetary policies

- Mainstreaming of climate risk analysis in public financial management and supporting the development of a climate disaster risk financing and insurance architecture

- Supporting climate vulnerable countries with debt sustainability problems

- Developing the IMF toolkit for climate emergency financing

- Exploring options to use Special Drawing Rights (SDRs) to support climate vulnerable countries

- Supporting the design and implementation of carbon pricing mechanisms

- Institutionalizing collaboration between the Fund and the V20

September 16, 2020: Set against the backdrop of the Covid-19 pandemic and record-breaking extreme weather events such as typhoon Ampham in South Asia, members of the governing body of the InsuResilience Global Partnership, the High-Level Consultative Group (HLCG) came together in their third meeting yesterday night to discuss the Partnership’s response to a changing risk environment.

The increasing risk of both, natural hazards and pandemic crises represents fundamental challenges to vulnerable countries’ development and economic growth. As highlighted by Alfred Alfred Jr., Finance Minister of the Republic of the Marshall Islands, who co-chairs the Partnership on behalf of the V20 Group, vulnerable countries “must start building resilience now as the frequency and intensity of climate-induced disasters grow worse over time and will make us even more vulnerable.” Otherwise, so the Minister, the failure to mobilize investment in preparedness and resilience will “leave hundreds of millions of people and our economies in extreme danger.”

In fact, 2020 has shown just how much preparedness, including through access to pre-arranged, predictable and reliable financing, and the upscaling thereof, matters. Like every other country, V20 members were unprepared for the Covid-19 crisis. Yet, unlike every other country, the majority of V20 membership was and is facing typhoons, hurricanes, heavy rain or sudden drought at the same time. In many cases, however, national set asides or financing streams for emergencies such as health crises or natural hazards, are insufficient and already depleted. Bangladesh and the Philippines, for example, were hit by typhoons right during the economic lockdown; and Ethiopia is dealing with the pandemic on top of significant locust infestations due to the increased humidity linked to cyclones. The same goes for many others.

Proactive investments in risk analysis and risk reduction, including in early warning systems and digital infrastructure, as well as in risk financing mechanisms such as sovereign insurance and social protection, can allow to combine responses to the pandemic and climate impacts; and thus maximize their cost-effectiveness in light of scarce resources.

The HLCG therefore decided to use “these challenging times to turn challenges into solutions and to see the challenges as a chance for further strengthening our Partnership”, as stated by Germany’s State Secretary Ms Flachsbarth, the G20 Co-Chair of the HLCG. Going forward, the Partnership will thus address compound risk, particularly at the intersection of health and climate change. This will entail exploring beneficial overlaps between risk finance mechanisms and pandemic risks, including the preparedness infrastructure and analytical work that comes with that. While in early stages, such approach can contribute to a fundamental shift towards more risk-informed development and economic growth.

While being riddled by crisis, 2020 at the same time also signifies one of the key moments in addressing the climate emergency. One of the most important milestones in the run-up to COP26 is the updating process of countries’ Nationally Determined Contributions (NDCs). NDCs outline how countries plan to address and respond to climate change – and can essentially provide a blueprint for the restructuring of economies in line with low-carbon and climate resilient development. Integrating risk financing considerations into such planning can offer benefits beyond financial protection: through detecting and pricing risk, they can also help attach real value to resilience investments, including in climate-proof infrastructure.

Recognizing the importance of enhancing resilience action in the run-up to COP26, the HLCG therefore agreed to support the integration of risk finance into national resilience planning in the context of NDCs and National Adaptation Plans. In doing so, the Partnership will build on collaboration with key partners, such as the NDC Partnership, the UNFCCC, and the Insurance Development Forum and also work on enhancing data availability key to risk analysis. This work will also support the Partnership’s target to reach a total of 80 vulnerable countries that have comprehensive risk management strategies in place by 2025. Furthermore, with adaptation remaining grossly underfunded, making sound economic sense of resilience investments by eliciting their true value through enhanced risk analysis and pricing is urgently needed to shift public and private finance.

The meeting, which also gave HLCG members space to issue their joint Declaration on Gender and update their Governance Charta, marked the first major engagement between G20 and V20 countries during the global pandemic. With Covid-19 having catapulted risk, preparedness, risk financing and resilience to the forefront of international debates, while also painfully reminding everyone of joint vulnerabilities in the context of globalized financial markets and trade, strong cooperation within the InsuResilience Partnership and beyond, is of utmost importance. And given the ticking clock on climate change, it has never been more urgent.

By: Sara Jane Ahmed, V20 Finance Advisor

The coronavirus pandemic is causing global disruption and uncertainty that will continue for many months to come and will have implications on livelihoods, economic growth, fiscal space, investment, and losses to financial and human capital. It will make even more vulnerable the lives of those already living in precarious economic conditions.

Prior to the Covid-19, the Vulnerable Group of Twenty (V20) Ministers of Finance, which represents 48 developing countries, were the fastest growing in the world, supported by strong demographic trends. While the Covid-19-led economic lockdown may cause uncertainty, the growth profile is driven into further uncertainty because of the impacts of climate change, both in the form of disasters that are growing in intensity and frequency, and accumulating long-term financial risks as a result of accelerated climate change, technology, economic and financial headwinds.

There is already mounting debt in climate vulnerable developing countries with more than US 2.3 trillion of external debt and this, in combination with a collapsing GDP, 10-40% decline in remittances, and a large fiscal effort during the Covid-19 lockdown, during recovery and to sustain growth, means more debt. Vulnerable developing countries may be ill-prepared for future shocks and worsening long-term climate-related risks such as sea-level rise, drought and pest infestation.

Conventional financial theory already significantly underestimates risk and consequently underestimates the importance of investments and action to reduce climate vulnerability and increase sustainability. Risk underestimation damages economies, in particular micro, small and medium enterprises (MSMEs), and the poor and vulnerable that rely on them.

Financial protection for the extreme poor and vulnerable people remains low with disaster risk reduction financing per capita at 66 US cents between 2010 and 2018. So far, US$48 billion has been committed by international institutions to help countries manage the fallout from the Covid-19 pandemic with US$23 billion from the IMF, US$10.6 billion from multilateral development banks and US$1.3 billion from the UN Global Humanitarian Response Plan. Of these commitments, 96% has been loans of which 27% are on concessional terms.

Moreover, only 25% of bilateral financing and less than 50% of multilateral financing has targeted the most climate vulnerable countries with climate change adaptation funding. The Covid-19 global pandemic brings with it the consequence of undermining or reversing any development gains so far. Prior to Covid-19 and compounding damages of climate change, the annual international funding gap for social services and social protection alone was US$84 billion with 87% of the total required in low income countries.

While analytics points to the fact that resources are not correlating to where science and practice indicates vulnerability is located, this is a great opportunity for donors to become more effective with their support. Moreover, the recovery packages present an opportunity to drive economic transformation that yield positive welfare effects for the poor and vulnerable and jumpstart the MSME growth engine they rely on.

Some actionable opportunities for actors engaged in the financial protection agenda such as the InsuResilience Global Partnership include: (1) open-source and accessible climate data and treatment of data by enabling cost-benefit analysis towards better risk reduction, risk management and resilience investments; (2) more South-South and country originated activities in vulnerable countries, which relates to increased capacities and streamline of international funding mechanisms to expand beyond capacity building and technical assistance, but also on implementation; (3) while large agencies favor large countries due to scale, there must be more effort and emphasis to work in smaller markets, which are increasingly becoming more exposed to climate change with a growing protection gap; and (4) North-South global cooperation in joint risk sharing can be facilitated through enhanced concessional support.

Sources:

- Hill, R. et al. (2020). Funding COVID-19 response: Tracking global humanitarian and development flows to meet crisis needs. Retrieved from https://bit.ly/3bHEj24

- Tilly, A. (2020). At what cost? How chronic gaps in adaptation finance expose the world’s poorest people to climate chaos. Retrieved from https://bit.ly/32cnJ7w

- Overseas Development Institute [ODI]. (2015). Financing the Future: How International Public Finance Should Fund a Global Social Compact to Eradicate Poverty. Retrieved from https://bit.ly/3hdVdXd

Ahead of the New York Climate Summit on September 23, the V20 Group* kicked off their Sustainable Insurance Facility (SIF) by discussing the proposed Operationalization Framework with key partners. In doing so, the V20 call for greater ambition and action for addressing a key gap within the existing climate and disaster risk financing architecture: The lack of climate-smart insurance for micro, small and medium enterprises (MSMEs) in vulnerable economies.

The event itself was framed by introductory remarks from Sayed-Khaiyum, Fiji Minister for Economy, as well as official representatives from the German Federal Ministry of Economic Cooperation and Development, who both acknowledged the need for accelerated action in V20 economies.

The target group selected by the V20 – MSMEs – was identified due to the substantial contributions they make to employment, GDP, tax revenue, and export, with instrumental effects for fiscal health, financial stability and socio-economic development. At the same time, many MSMEs are highly vulnerable to climate change and increasingly threatened in their productivity, leading to severe ripple effects for those dependent on MSMEs and knock-on effects to the wider economy. Specifically, during a shock, MSMEs may deplete savings, sell productive assets or be forced to borrow at high interest rates to bridge the funding gap. In the absence of financial protection measures such as insurance, it is often only the public budget that can be utilized. This additional pressure in combination with losses to employment and GDP can squeeze public resources further.

As such, climate-smart insurance solutions for MSMEs can help to ensure financial protection and enable productivity. The term ‘climate-smart’ is meant to capture a dual need, namely for (a) insurance products which enable low carbon investments, and thereby contribute to increased efficiencies through cost savings and CO2-mitigation, as well as (b) climate risk insurance, enhancing protection and productivity. The SIF as put forward by the V20, seeks to enhance the development and implementation of exactly those solutions, including through stronger private sector engagement on both ends, the demand and the supply side.

The Draft SIF Operationalization Framework, developed jointly by MCII, the UNEP Principles for Sustainable Insurance (PSI) Initiative and the V20 Finance Advisor, provides a proposal for achieving these goals through collaborative efforts among key partner institutions. Through combining complementary action under dedicated financing vehicles managed by these institutions – the Asia Pacific Climate Finance Fund (ACLIFF, managed by the Asian Development Bank), the InsuResilience Solutions Fund (ISF, managed by KfW and the Frankfurt School), the InsuResilience Investment Fund (IIF, managed by KfW and BlueOrchard) and the Natural Disaster Fund (NDF, managed by Global Parametrics) – the MSME protection gap can be addressed sustainably.

“Despite their importance, MSMEs inherently face a wide spectrum of risks, many of which are commercially uninsurable. I hope we are able to garner support for the Sustainable Insurance Facility which aims to significantly increase insurance coverage for populations, livelihoods and economic assets against climate and disaster risks,” said Ywao Elanzo Jr, Assistant Secretary in the Ministry of Finance of the Republic of the Marshall Islands.

In Bangladesh, for example, climate change is expected to decrease agricultural GDP by 3.1% each year, equal to US$36 billion. The loss increases to US$129 billion in indirect impacts on complementary industries. “Needs-responsive financial protection, which supports pro-active risk management and risk reduction, in line with strong, country-led CDRFI frameworks is key to ensure sustainability in solutions,” said Soenke Kreft, Executive Director of Munich Climate Insurance Initiative.

To fully capitalize on the respective strengths of each of the dedicated financing vehicles, the proposed Draft SIF Operationalization Framework will be further refined over the coming months together with the key partner institutions. Further supported through MCII and the UNEP PSI Initiative, the SIF will be launched at the next Spring Meetings of the International Monetary Fund and the World Bank in April next year.

* The Vulnerable Group of Twenty (V20) Ministers of Finance from 48 countries is a dedicated dialogue and action platform that works on financial responses to maintain and strengthen fiscal stability and economic resilience in the face of climate change. This includes addressing investments to enable climate-proof growth, reduce exposure to transition and climate risk, carbon pricing, and tackling increasing cost of investment capital due to climate vulnerability. Complementary to these priorities, the final priority area of the V20 is to enhance systematic, climate-smart insurance for micro, small and medium enterprises (MSMEs) in vulnerable countries. This V20-led demand was first expressed in 2016 and culminated in the request for the Sustainable Insurance Facility (SIF) to support climate-proof growth and development.

MCII and the UNEP PSI Initiative are technical partners of the V20. Together with the V20 Finance Advisor, they form the SIF Technical Support Team. The technical work on the SIF is supported by the German Federal Ministry of Economic Cooperation and Development through the Insuresilience Global Partnership Secretariat.

To find out more about the Sustainable Insurance Facility (SIF), read the SIF Kick-Off Summary HERE.

You can download the SIF Kick-Off Event Summary HERE.

To find out more about the V20 and the SIF, read the SIF press release HERE.

Download the DRAFT High Level V20 Needs & Support Assessment HERE.

Washington DC, April 2019:

Finance Ministers from the V20 Group of vulnerable economies announced new financial instruments in collaboration with international partners at the Spring Meetings of the World Bank Group and International Monetary Funds.

The V20 Group of Finance Ministers is a dedicated cooperation initiative of economies systemically vulnerable to climate change. The V20 announced ambitious commitment to achieve energy transition and resilience of their economies in line with the most ambitious climate protection scenarios. It is currently chaired by the Republic of Marshall Islands.

In furthering the ambitions of the group, the V20 announced the preparation of two decisive initiatives during the WB & IMF Spring Meetings: Firstly, the V20 has proposed the Accelerated Financing Mechanism (AFM) for Maximal Resilience & a 100% Renewable Energy Transition to upscale existing risk mitigation tools, guarantees and blended finance facilities, and a new menu of instruments within MDBs and other development banks for adaptation, resilience and renewable energy projects.

Secondly, the Sustainable Insurance Facility (SIF), intends to promote private sector insurance uptake to address climate risks and promote low-carbon development. It seeks to support the provision of financial protection instruments that strengthen the resilience of micro, small and medium-sized enterprises (MSMEs), including of the various vulnerable groups along the supply chain. The V20 sees the SIF as a tool that can crowd in investments in risk reduction, enhance credit access, and better manage public contingent liabilities related to social resilience.

During the round table discussions on the 12th of April both representatives from V20 economies, partners from G20 countries, and heads of international agencies, discussed these concepts and highlighted the need for V20 countries to further press the international agenda especially in the run-up to the UNSG Climate Summit in New York. The risk finance agenda is a key item – underpinned by the V20 contributions, and the V20 chair’s role towards the InsuResilience Global Partnership (IGP) on Climate and Disaster Risk Finance and Insurance Solution. During the roundtable the IGP was mentioned as a primary example of existing V20 leadership.

MCII is a supporting partner to the V20 on the financial protection agenda and contributed to the round table.

The Disaster Risk Management community has been advocating for integrated and complementary approaches to financing the negative effects of climate disasters. Risk transfer solutions, in particular macro and microinsurance, have been applied simultaneously in national contexts. In spite of this, policymakers and practitioners in macro and microinsurance schemes have struggled to find areas of common support. Theoretically, linkages could lead to process and resource efficiencies, ultimately enhancing the effectiveness of DRM strategies. Being aware of the importance of this issue, the InsuResilience Secretariat has deemed it essential to foster reflection on this topic through a session at the Microinsurance Conference held in Lusaka during November 6-8, 2018.

MCII’s fourth discussion paper elaborates on some of the ideas discussed during the preparations and the event, and reflects on the challenges faced by policymakers, practitioners and the private sector when developing comprehensive risk transfer approaches. Additionally, these ideas are complemented with insights from the literature. Lastly, this paper provides guidance on how these linkages could be furthered in the future.

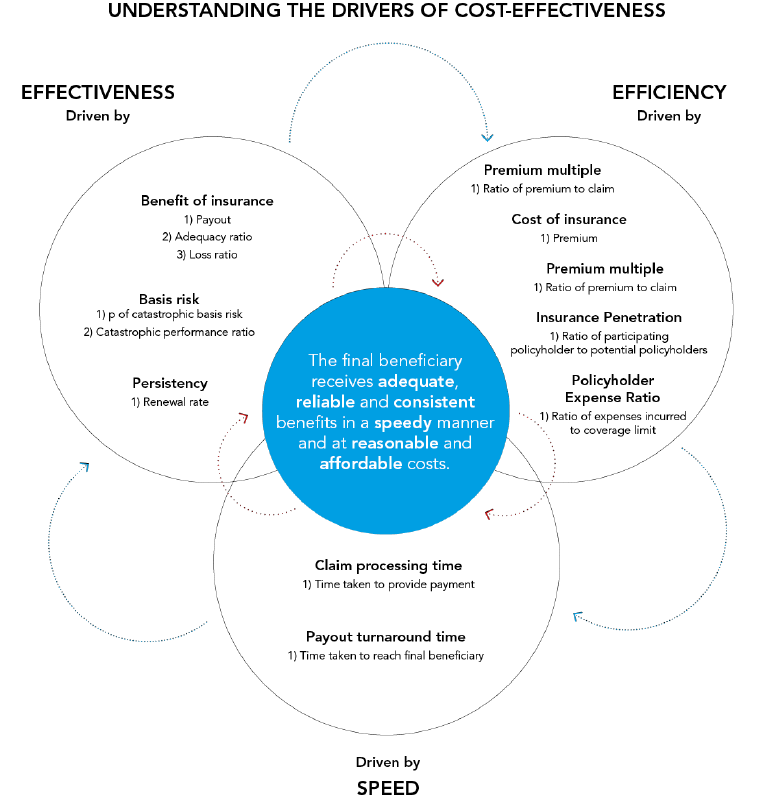

DownloadBuilding on a Multi Criteria Cost Effectiveness Analysis (MCCEA), this paper aims to develop an assessment framework that facilitates a comprehensive understanding of cost-effective climate risk insurance (CRI) approaches for vulnerable populations. MCCEA helps compare and select risk financing instruments based on their costs and overall effectiveness: Instead of taking a one-dimensional approach that only compares costs per unit of effectiveness, MCCEA conceptualizes cost-effectiveness more holistically. It integrates the assessment of efficiency and effectiveness into one framework, including criteria for parameters that cannot be reflected in traditional cost-benefit analysis (CBA) and/or cost-effectiveness analysis (CEA), such as the speed of disbursement and risk assessments. Accordingly, this paper sets out to define three key determinants of cost-effectiveness (Effectiveness, cost-efficiency and speed of disbursement) in order to arrive at their respective drivers and key performance indicators (KPIs), allowing to discern and measure the impact of CRI instruments. Ultimately, this exercise results in a comprehensive assessment framework which we then apply to ARC, CCRIF, PCRIC and R4 to illustrate the information that may be inferred.

And while the assessment framework does not lend itself to comparing different insurance schemes (e.g. different objectives, eligibility requirements and the therewith associated welfare benefits, coverage of different perils and risk layers) or disaster risk finance instruments (e.g. contingent credit etc.), singular KPIs can be selected to understand the differences of advantages offered.

As such, this paper thus contributes to:

- Create a common understanding of the components of CRI cost-effectiveness and an assessment framework to help focus future discussions;

- Allow for decision- and policymakers to assess the cost-effectiveness performance across comparable CRI schemes, while having to accommodate sometimes conflicting decision-making criteria;

- Illustrate the application of the developed framework for four prominent CRI schemes;

- Based on (3), provide illustrative recommendations on the schemes’ performance and the thereof derived needs for further action, innovation, and research.

We find that the cost-effectiveness performance of the analyzed CRI schemes (ARC, CCRIF, PCRIC, R4) is largely within reasonable bounds. Even though the schemes may not have proven to be constantly cost effective – especially during their initial years when they were still building financial and operational capacity – the schemes seem to become increasingly stable when maturing over time. While this shows the principal viability of CRI as a risk financing solution, additional efforts need to be brought underway to make insurance protection more accessible and more valuable to vulnerable people and countries.

Going forward, public institutions, businesses and civil society should therefore work to further improve the cost-effectiveness of CRI by:

- Addressing remaining stumbling blocks to increase the cost-effectiveness of CRI through integrative disaster risk management and insurance solutions, providing holistic coverage for micro schemes, income-friendly product pricing, regulatory frameworks and technology advancements.

- Strengthening product innovation through innovative risk models, including residual risk layering and risk pooling, inter-regional risk pooling, including the harmonization of financial services regulations across borders, and peer-to-peer insurance

- Promoting research that drives forward discussions to enhance cost-effectiveness, including on the evaluation and integration of intangible, non-monetary benefits, the measurement of basis risk, the development of tracking tools for payout utilization, additional financial performance integrators, integration and expansion of existing assessment frameworks to allow for the comparison across different combinations of CDRF instruments and insurance.

Download

InsuResilience Global Partnership Seen as Key Collaboration Between V20 and G20 Countries.

Building on the progress reached since the last V20 Focus Group Meeting in August in Addis Abeba, V20 member countries re-convened in Bali for their Fifth Ministerial Meeting and their Second Dialogue with High-level G20 Representatives. The meetings gathered significant momentum and are bound to result in more ambitious climate action in the run up to 2020, including gathering more support during other high level meetings along the way, such as the upcoming Climate Vulnerable Forum Virtual Summit in November, at COP24 in Catovice, in December, and the Climate Summit in 2019.

Held in conjunction with the Annual Meetings of the World Bank and the International Monetary Fund, the V20 Finance Ministers urged the global financial community and particularly G20 member countries to begin moving from words to action and proactively address the risks and opportunities climate change bears for the financial system and the world economy.

In their statements, the V20 countries pointed to the most recent IPCC Assessment Report (AR6) published just days before, to explain why shifting financial flows and by that the real economy towards 1.5°C aligned investments will substantially reduce climate risks and improve economic growth scenarios. Doing so, however, requires meaningful commitments and actions by G20 countries, including for industrialized states to follow up on their USD 100 billion climate finance pledge, as well as stronger cooperation between the V20 and the G20 Groups.

Unlocking investments for countering climate change relays to both – facilitating the climate resilient and low carbon transition of V20 economies, so that their populations not only merely survive, but thrive. V20 countries highlighted the InsuResilience Global Partnership as the first of its kind strategic collaboration between the V20 and the G20 to address climate risks through insurance and other financing instruments. Similar arrangements for other issues areas, including enabling the low carbon energy transition and building the necessary capacities across V20 economies need to follow.

Already, the V20 are advancing with implementing domestic carbon pricing mechanisms and the development of innovative financing mechanisms to help protect and build climate-friendly and resilient economies. The envisioned V20-led Sustainable Insurance Facility (SIF), a mechanism for technical assistance with implementation at the country level, is aimed at facilitating insurance solutions protecting vulnerable population segments, but also structurally relevant industries vulnerable to climate change as well as MSMEs. This is considered essential to shielding V20 economies from being locked in at development levels way below their growth potential and keeping them from realizing significant societal benefits economic advancement has to offer. For the SIF, the V20 is looking to deepen cooperation with existing structures such as the InsuResilience Global Partnership and Global Risk Financing Facility (GRiF) that was launched in Bali. The Accelerated Financing Mechanism, a second financing initiative currently under way, aims to leverage available multi-lateral and bi-lateral funding to make private sector investment viable for core national priorities on resilience building and 100% renewable energy.

Germany, as one of the leading G20 members of the InsuResilience Partnership reaffirmed its commitment to the objectives of InsuResilience and to working with the V20 to drive forward the use of climate and disaster risk financing instruments.

The Bali meetings demonstrated the commitment, the ambition and the willingness of the present V20 and G20 countries, but also the substantial work that remains. H. E. Brenson S Wase, Finance Minister of the Republic of the Marshall Islands and current V20 President made this very clear, when he highlighted the existential threat posed by climate change and urged the G20 to “deepen international collaboration to hasten the world’s transition to climate-resilient and low carbon development.” In the upcoming months, both groups urgently need to follow suit. MCII, as one of the technical support partners for the V20 during their meetings in Addis Abeba and Bali, is also committed to keep engaging with the V20 on advancing this critical work.

Sovereign risk pools constitute one mechanism to protect countries and their populations against the immediate impacts of disasters. In recent years, regional risk pools such as the Caribbean Catastrophe Risk Insurance Facility (CCRIF) have drawn increasing attention and interest, leading to the creation of the African Risk Capacity (ARC) in 2012, and the launch of the pilot insurance programme of the Pacific Catastrophe Risk Assessment and Financing Facility (PCRAFI) in 2013.

Until today, the three pools together have disbursed around 40 payouts to their member states and thereby helped deliver timely relief to affected states and individuals. CCRIF’s payouts, for example, have been used to maintain the payment of government salaries after disaster and to repair critical infrastructure, including bridges and roads. PCRAFI payouts on the other hand have helped to dispatch medical personnel to impacted areas and to transport emergency goods across the sea, while the funds disbursed by ARC supported the distribution of food and fodder as well as conditional cash transfers. As the respective pools‘ policy renewal rates show, these benefits are valued by many of their members, who continue to use climate risk insurance as part of their climate and disaster risk financing strategies. The support of regional risk pools as a risk financing solution is further substantiated when looking at Southeast Asia, where a fourth pool, the Southeast Asia Disaster Risk Insurance Facility (SEADRIF) is currently under development.

In light of these developments, questions around the transparency and accountability of these risk pools as well as the ability of civil society to engage constructively with them attract increasing attention. This paper discusses the importance of these themes in the context of sovereign climate risk insurance as well as highlights their positive influence on ensuring that the pools benefit those most vulnerable to climate impacts, building public support and improving institutional effectiveness.

This paper focuses on the three risk pools CCRIF, PCRAFI and ARC, and aims to improve understanding of how the requirements of transparency, participation and accountability apply to them by developing corresponding assessment criteria against which the pools are then evaluated. In doing so, the author builds on desk-based research as well as a number of semi-structured interviews with individuals involved in work on and around those risk pools. It finds that – for all of the three pools – gaps remain, but also demonstrates they have made or are making valuable efforts to increase their transparency, accountability and engagement with civil society. In concluding, the paper outlines a set of recommendations for several stakeholders on how to further improve on ‘good governance‘, encompassing civil society organisations, policy holders (governments), donor countries, the World Bank, and the regional risk pools themselves.

In the run up to the G7 Summit in Charlevoix, the G7 Finance and Development Ministers convened in Whistler to discuss several topics related to the overarching theme of “Investing in growth that works for everyone”, including issues surrounding the management of extreme weather events in developing countries.

Overall, the G7 summit of leaders provides a substantial opportunity for shaping the commitment of industrialized countries and to define their responsibilities vis-à-vis global key challenges. The G7 summit in Elmau, 2015, proved pivotal for establishing an international commitment on providing poor and vulnerable people with insurance cover in order to protect developing countries against extreme climate impacts. It was also essential for organizing much needed political momentum for the Paris Agreement on Climate Change in 2015.

Yet, in 2018 the situation stood in stark contrast to previous summits. In light of swelling conflicts around trade, nationalist and self-interested tendencies re-surfacing across G7 countries, Russia re-turning to the world stage with increasing force, and a US President who withdrew from the Paris Agreement and follows his ‘America First’ agenda, only limited progress was to be expected.

Nevertheless, the Ministerial Meeting on Finance and Development in Whistler a week before the G7 Summit made progress on several issues important to climate risk insurance and disaster risk financing. The discussions were structured around women’s economic empowerment and around innovative financing for development, including mobilizing private capital for sustainable development and building economic resilience against extreme weather events.

The elements below summarize the most important outcomes of the Whistler Summit:

Shared understanding that the world’s most vulnerable countries are disproportionally affected by extreme weather events;

International financial institutions called on to assess the role of disaster risk insurance coverage and to propose approaches supportive of more gender responsive disaster risk financing mechanisms to help building economic resilience against extreme weather events;

Strengthened capacities of public financial management to advance sustainable development in developing countries stressed in the context of mobilizing private capital for sustainable development;

Endorsement of the Whistler Principles for Accelerating Innovation for Development Impact to promote, inter alia, the usage of data to drive decision-making, inclusive innovation and smart risk taking;

Shared agreement on the importance of financial inclusion, including access to capital and credit, as key enabler of resilience and poverty eradication and on promoting the importance of women’s financial inclusion together with the G20 and others to support women’s economic empowerment;

Shared commitment to differently address and reduce humanitarian need, risk and vulnerability to strengthen the resilience and self-reliance of affected populations in context of the Whistler Declaration on Gender Equality and the Empowerment of Women and Girls in Humanitarian Action.

Following the launch of the InsuResilience Initiative in 2015, interest in climate risk insurance (CRI) as a means to strengthen climate resilience in developing countries has increased substantially – as have the number of voices calling for impact evaluations that identify and assess the ways in which CRI affects resilience.