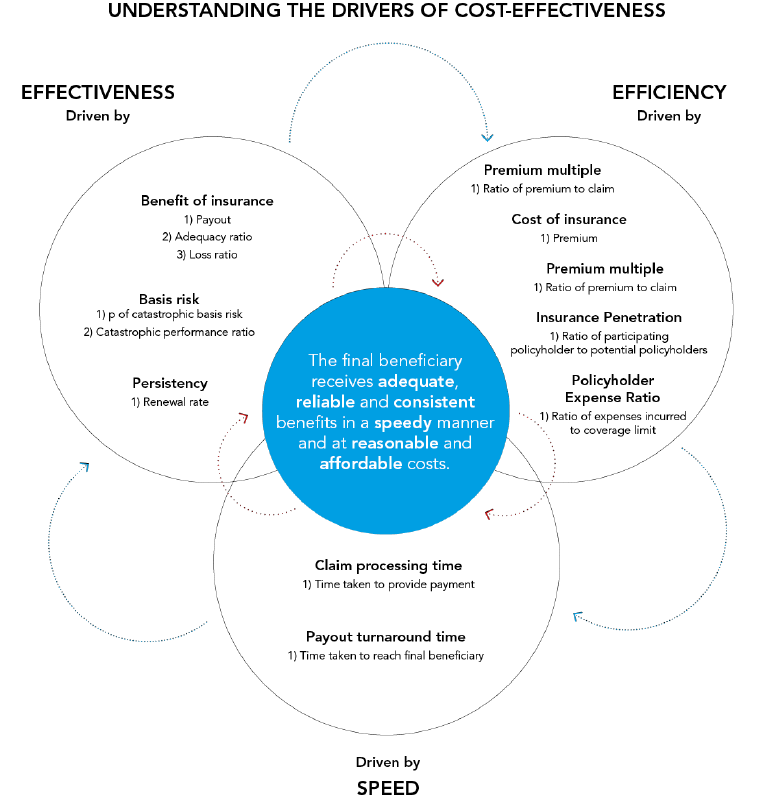

Building on a Multi Criteria Cost Effectiveness Analysis (MCCEA), this paper aims to develop an assessment framework that facilitates a comprehensive understanding of cost-effective climate risk insurance (CRI) approaches for vulnerable populations. MCCEA helps compare and select risk financing instruments based on their costs and overall effectiveness: Instead of taking a one-dimensional approach that only compares costs per unit of effectiveness, MCCEA conceptualizes cost-effectiveness more holistically. It integrates the assessment of efficiency and effectiveness into one framework, including criteria for parameters that cannot be reflected in traditional cost-benefit analysis (CBA) and/or cost-effectiveness analysis (CEA), such as the speed of disbursement and risk assessments. Accordingly, this paper sets out to define three key determinants of cost-effectiveness (Effectiveness, cost-efficiency and speed of disbursement) in order to arrive at their respective drivers and key performance indicators (KPIs), allowing to discern and measure the impact of CRI instruments. Ultimately, this exercise results in a comprehensive assessment framework which we then apply to ARC, CCRIF, PCRIC and R4 to illustrate the information that may be inferred.

And while the assessment framework does not lend itself to comparing different insurance schemes (e.g. different objectives, eligibility requirements and the therewith associated welfare benefits, coverage of different perils and risk layers) or disaster risk finance instruments (e.g. contingent credit etc.), singular KPIs can be selected to understand the differences of advantages offered.

As such, this paper thus contributes to:

- Create a common understanding of the components of CRI cost-effectiveness and an assessment framework to help focus future discussions;

- Allow for decision- and policymakers to assess the cost-effectiveness performance across comparable CRI schemes, while having to accommodate sometimes conflicting decision-making criteria;

- Illustrate the application of the developed framework for four prominent CRI schemes;

- Based on (3), provide illustrative recommendations on the schemes’ performance and the thereof derived needs for further action, innovation, and research.

We find that the cost-effectiveness performance of the analyzed CRI schemes (ARC, CCRIF, PCRIC, R4) is largely within reasonable bounds. Even though the schemes may not have proven to be constantly cost effective – especially during their initial years when they were still building financial and operational capacity – the schemes seem to become increasingly stable when maturing over time. While this shows the principal viability of CRI as a risk financing solution, additional efforts need to be brought underway to make insurance protection more accessible and more valuable to vulnerable people and countries.

Going forward, public institutions, businesses and civil society should therefore work to further improve the cost-effectiveness of CRI by:

- Addressing remaining stumbling blocks to increase the cost-effectiveness of CRI through integrative disaster risk management and insurance solutions, providing holistic coverage for micro schemes, income-friendly product pricing, regulatory frameworks and technology advancements.

- Strengthening product innovation through innovative risk models, including residual risk layering and risk pooling, inter-regional risk pooling, including the harmonization of financial services regulations across borders, and peer-to-peer insurance

- Promoting research that drives forward discussions to enhance cost-effectiveness, including on the evaluation and integration of intangible, non-monetary benefits, the measurement of basis risk, the development of tracking tools for payout utilization, additional financial performance integrators, integration and expansion of existing assessment frameworks to allow for the comparison across different combinations of CDRF instruments and insurance.